New Automotive Electronics Systems Drive Connector Growth

It’s no secret that the proliferation of electronics systems in vehicles such as collision avoidance, lane-change warning, telematics, LED lighting, backup cameras, and others is resulting in strong demand for a wide range of semiconductors.

In fact, many chipmakers often point to the automotive sector as a bright spot in the industry because demand for sensors, power management ICs, memory chips, LEDs, microcontrollers, discretes, and other chips by automakers is growing, while demand from traditional segments is flat or has slower growth rates.

But the auto industry is having positive impact on connector industry sales, too. The proliferation of electronic systems in vehicles is also driving demand for connectors, cable assemblies, and wire harnesses, according to connector manufacturers and industry analysts. As a result, some connector makers are devoting more capacity and resources to the auto industry because of rising demand as the percentage of their total sales from automakers increases.

Strong Auto Connector Growth

“What we are seeing is automotive interconnect is outpacing the rest of the market 2 to 1,” says David Einhorn, business development manager at connector manufacturer Amphenol, based in Wallingford, Conn. “In 2016 while the connector market grew 4%, automotive interconnect grew by about 8%,” he notes.

Einhorn said in recent years automotive has become a more important vertical segment for Amphenol. “Right now, automotive comprises 18% of our sales. Three years ago, the number was 12%. It has been in increasing focus for us that’s for sure,” says Einhorn.

He added that at Amphenol automotive has outpaced every other vertical market. “It is because of organic growth along with our strategic acquisitions,” he says.

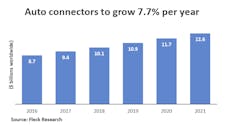

Monalisa Berbey, CEO and president of Fleck Research, based in San Clemente, Calif., said the compound annual growth rate for automotive connectors over the next five years will be 7.7%. Sales are expected to rise from $8.7 billion in 2016 to $12.6 billion in 2021, she said. When sales of automotive connector assemblies, backplane assemblies and wire harnesses sales are added to connector revenue, total automotive connector and assembly sales totaled $85 billion in 2016.

Not Just a Car Anymore

That growth is due to new electronics systems, which reflect what drivers expected of a vehicle. “Cars we drive are no longer strictly modes of transportation,” says Mark Rettig, global marketing director, transportation, for connector manufacturer Molex, based in Lisle, Ill. He said people want studio-quality sound systems, movie systems, advanced driver assistance systems (ADAS), telematics, heads-up displays, seamless connectivity, access to office files, the internet, business contacts, and family and friends “via the touch of a button or voice control. They expect to know where they are, where they are going, how to get there, and exactly when they will arrive at their destination.” He said to help meet those requirements more connectors are being used in vehicles.

Berbey agrees. She says five years ago, the average vehicle had about 240 connectors. Today, there are an average of 274 connectors in a vehicle. She adds that automakers use a wide range of connectors including printed circuit board, rectangular, circular, power, and charging connectors among others. Because of increasing communications applications in vehicles, there is greater demand for high-speed, high-frequency connectors, says Berbey.

“The impact of the auto industry on connectors is significant,” says Einhorn. “You have more features and functionality. Content is not only growing, but the pace of that growth is accelerating.”

He said that the emergence of new features in vehicles “is really exciting. Driver assistance, parking assistance, lane change warning, displays, cameras, infotainment, telematics, these systems a decade ago did not exist or were just being thought of,” says Einhorn.

Many of those features are resulting in the need for more sophisticated, higher-speed connectors.

Rettig said automotive infotainment, integrated smart phone connectivity, turn-by-turn navigation, and driver-assist applications are “pushing in-vehicle bandwidth and connectivity to new heights.”

The Need for Speed

With the advent of autonomous cars and increased demand for ADAS and connectivity including vehicle-to- vehicle (V2V), vehicle-to-infrastructure (V2I), and vehicle-to-cloud (V2C), in-vehicle data is burgeoning, with Ethernet speeds increasing from 100MB/s up to possibly 20GB/s, said Rettig.

“These higher data rates demand higher-performance interconnect systems, which have been a focus of technology development. These connectors need to be optimized for both data rate and speed, with the robustness to withstand the automotive harsh environments,” he says.

Einhorn said connector technology in vehicles is changing. For instance, more USB type C connectors will be used in the future. USB type-C is a 24-pin, fully reversible plug USB connector system for transporting data and energy.

“Expect to start seeing USB type-C in model year 2019 vehicles,” says Einhorn. “Eventually the type-C may replace type-A in vehicles, but since the type A is so ubiquitous, we will likely see both receptacles in automobiles for quite some time.”

There will other changes in connectors used in automotive applications. “I’ll give you an example,” says Einhorn. “HSD has been the de facto kind of high-speed data connector within the vehicle for a number of years. Now there is a new push toward automotive Ethernet.” An automotive Ethernet approach can reduce connectivity cost and cabling weight.

“With automotive Ethernet, you have a more functional, or capable connector, but it is much lighter. It goes beyond the limitations of the traditional HSD connector from a throughput standpoint,” says Einhorn. “The industry is just now starting to agree on new connector standards. In the next several years there will be a migration away from HSD in favor of a more capable, flexible and lighter weight connector family.”

In some cases, connectors designed for industrial and mil-aerospace applications are being used in automotive. For instance, Amphenol’s Radsok connector was developed for the industrial market segment, said Einhorn.

“It is used in power grid applications and military in oil and gas industries” and is used in harsh environments, said Einhorn. Now it is being used in charging systems for electric cars.

“It is a unique contact that allows for many tens of thousands or hundreds of thousands of mating cycles. It can also handle voltages and amperages far better than other contacts out there,” he says.

Connector manufacturers say that electronics systems in vehicles will continue to grow and become more sophisticated and there will continue to be robust demand for connectors.

“I don’t see automotive connector growth slowing down,” says Einhorn. “To me we are just really getting started.”

Automotive connector sales to grow 7.7% per year

Automotive connector sales will be steady over the next five years as vehicles are equipped with more connectors.

About the Author

James Carbone

Freelance Writer

Jim Carbone is a freelance writer covering the electronics supply chain. A veteran journalist, Jim was a writer and editor for Electronics Purchasing and Purchasing magazines for 21 years. He covered electronics distribution, semiconductors, passive components and connectors for the magazines. He also wrote extensively about the strategic purchasing strategies of electronics OEMs and electronics manufacturing services providers. Before covering the electronics industry, Jim worked as a reporter and editor for United Press International for nine years. He started his career as a newspaper reporter and photographer. Jim is a graduate of the State University of New York at Albany.