Connected Cars Spell Opportunity for Manufacturing, Distribution

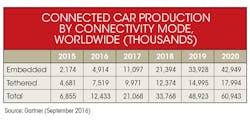

The connected-car market continues to be a boon to supply chain companies, as a recent survey by Gartner points to rapid growth in the market over the next five years. Production of new automobiles equipped with data connectivity—either through a built-in communications module or by a tether to a mobile device—is expected to increase 150%, reaching 12.4 million this year and rising to 61 million in 2020, according to Gartner.

This is good news to electronic components manufacturers and distributors, many of which point to the automotive marketplace as a bright spot in an otherwise murky economy. In a mid-year business outlook report this summer, electronic components distributors listed automotive and Internet of Things applications as two of the greatest business opportunities now and into 2017.

A “connected car,” as defined by Gartner, is capable of bidirectional wireless communication with an external network to deliver digital content and services, transmit telemetry data from the vehicle, enable remote monitoring and control, or manage in-vehicle systems.

“The connected vehicle is the foundation for fundamental opportunities and disruptions in the automotive industry and many other vertical industries,” said James Hines, research director at Gartner. “Connected vehicles will continue to generate new product and service innovations, create new companies, enable new value propositions and business models, and introduce the new era of smart mobility, in which the focus of the automotive industry shifts from individual car ownership to a more service-centric view of personal mobility.”

He went on to explain that connected-car technology is an opportunity for automakers to generate post-sale profits through sales of additional services and feature upgrades, as well as enhance brand loyalty through a more personalized customer experience. It also will spur innovations in adjacent businesses, such as insurance, car rentals, car- and ride-sharing services, and electric vehicle charging, the company said.

“As cars become more automated, they are being equipped with an increasing array of sensing technologies, including cameras and radar systems,” Hines explained. “Many automobiles will use image detection as the primary means to identify and classify objects in the vicinity of the vehicle so they can provide more sophisticated responses and even have autonomous control.”

The projected growth underscores the changing automotive landscape, which is marked by a need for deeper integration of electronic content. Gartner also points out that in order to become more automated—and cleaner—automobiles will need 5% more embedded processing functions, year over year, from 2016 through 2020.

“Automated driving functions, such as adaptive cruise control, collision avoidance and lane departure warning systems, necessitate real-time camera and sensor data processing and pattern recognition,” the firm said in its September 2016 report. “Improving fuel efficiency and reducing emissions necessitate sophisticated engine and transmission control systems.”

Chip Demand Rises

Other recent statistics echo the growth Gartner projects. In another report out this fall, IC Insights underscored strength in the connected cars market with its projection for semiconductor sales to the IoT market. Although IC Insights trimmed back its overall semiconductor forecast for IoT systems, it pointed to the automotive sector as a strong point, with semiconductor sales for automotive IoT applications experiencing considerable growth in 2016, and through 2019.

Overall semiconductor sales for IoT system functions are now expected to reach $29.6 billion in 2019 compared to the previous projection of $31.1 billion in the same time period—due mainly to lower projections for smart cities applications, the researcher said.

“The most significant changes in the new outlook are that semiconductor revenues for connected cities applications are projected to grow by a [compound annual growth rate] of 12.9% between 2014 and 2019 (down from 15.5% in the original forecast) while the connected vehicles segment is expected to rise by a CAGR of 36.7% (up from 31.2% in the previous projection),” IC Insights reported. “IoT semiconductor sales for connected cities are now forecast to reach $15.7 billion in 2019 while the chip market for connected vehicle functions is expected to be $1.7 billion in 2019, up from the previous forecast of $1.4 billion.”

Semiconductor sales for connected cars will see the most dramatic growth this year. For 2016, IC Insights says revenues of IoT semiconductors used in connected-cities applications are expected to rise 15% to about $11.4 billion while the connected vehicle category is projected to climb 66% to $787 million this year.

Other key segments of the IoT market also are slated for solid growth, including wearables, connected homes, and industrial applications. Sales of semiconductors for wearable IoT systems are now expected to grow 22% to about $2.2 billion in 2016, rising to nearly $3.9 billion in 2019. The connected-homes segment is expected to grow 26% in 2016 to about $545 million, and the Industrial Internet chip market is forecast to increase 22% to nearly $3.5 billion. The semiconductor forecast for IoT connections in the industrial Internet is expected to grow by a CAGR of 25.7% to nearly $7.3 billion in 2019 from $2.3 billion in 2014.

About the Author

Victoria Fraza Kickham

Distribution Editor

Victoria Kickham is the distribution editor for Electronic Design magazine, SourceESB and GlobalPurchasing.com, where she covers issues related to the electronics supply chain. Victoria started out as a general assignment reporter for several Boston-area newspapers before joining Industrial Distribution magazine, where she spent 14 years covering industrial markets. She served as ID’s managing editor from 2000 to 2010. Victoria has a bachelor’s degree in English from the University of New Hampshire and a master’s degree in English from Northeastern University.