Vietnam Becomes an Option for Low-Cost Electronics Manufacturing

More and more supply chain and procurement managers involved in outsourcing decisions are taking a closer look at Vietnam these days. And for good reason: The country has a growing electronics manufacturing industry and one of the lowest labor costs.

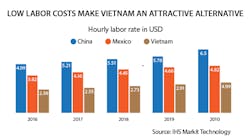

In 2016, the average hourly compensation for manufacturing workers in Vietnam was $2.38 per hour compared to about $4.99 in China and $3.82 in Mexico, according to researcher IHS Markit Technology. By 2020, Vietnam’s labor rate will be about $3.10 per hour, $6.50 in China and $4.82 in Mexico, IHS Markit projects.

Vietnam's average hourly compensation of $2.38 is less than half the average hourly compensation of China.

Global OEMs and electronics manufacturing services (EMS) providers including LG, Samsung, HP, Canon, Foxconn, Jabil, Sparton, and others are manufacturing printed circuit boards, camera modules, printers, servers, phones, networking equipment, televisions, and other electronics equipment, according to the researcher.

While Vietnam isn’t likely to surpass China as an electronics manufacturing powerhouse in the near future, industry analysts say that the country is becoming an important location for low-cost electronics manufacturing. It will be a long-term competitor to China and other low-cost manufacturing locations including Mexico and Eastern Europe.

The electronics industry is Vietnam is growing. Production was estimated at $31.1 billion in 2015, up from $2.6 billion in 2007, according to researcher Electronica.ca Publications. The growth is due to an increase in production of mobile phones, computers, LCD-TVs, and semiconductors, the company reported.

“Electronics manufacturing in Vietnam is growing like crazy and companies are adding capacity,” says Dan Panzica, chief analyst for the outsourced manufacturing intelligence service at IHS Markit Technology. Vietnam is focusing on “fairly simple, lower technology assembly. There's not a lot of design activity or tooling or joint development going on. It is assembly,” he says.

While automation in electronics manufacturing has eliminated a lot of the need for low-cost assembly, it has not eliminated it, says Panzica. “There is still a need for intricate hand assembly. The Vietnamese are very skilled at assembly work. Even better than the Chinese,” he says.

What’s more, says Panzica, the quality of products manufactured and assembled in Vietnam is very competitive. “You never hear of a quality problem coming out of Vietnam because the workmanship standards are so high,” he says.

While Vietnam has a low-cost workforce, its infrastructure is also good, according to Panzica. At least for the most part. The country has ports and airports, reliable power, and the internet. “Their road system is not quite as advanced, nor are their railroads, but everything is within trucking distance to ports. The electronics industry focuses on Ho Chi Minh City and Hanoi. Is very easy to get the products onto a boat or a container ship,” says Panzica.

While Vietnam has low labor costs and adequate infrastructure, it has a limited component supply base, which means components and other production materials need to be imported.

Several global semiconductor companies have factories in the country or have plans to build them. “ON Semiconductor and Intel are two better-known companies that operate facilities in Vietnam, but in both cases the facilities are for assembly and test. They are not wafer fabs,” says Brian Matas, vice president of research for IC Insights.

Vietnam’s chip market is expected to grow at a compound annual growth rate of 15.44% from 2016-2020, according to researcher Technavio.

As for other components, Murata has four factories in Vietnam building discretes, says Panzica. Sharp makes camera modules, Sumitomo Electric manufactures connectors, Nidec makes motors and fans, and Foster Electric makes audio and speaker modules, he said. Molex has factories in Vietnam producing connectors, a company spokesman said.

Two South Korean LED manufacturer plan to open factories in Vietnam. Seoul Semiconductor said it would invest $300 million and build a new LED assembly facility in Vietnam. LED manufacturer Lumens also announced it will begin operating an LED factory. Lumens is mainly a manufacturer of LEDs for TV and smartphone applications.

“While there is a limited supply base in Vietnam, it is growing,” says Panzica. “As device manufacturing takes hold, the component and module manufacturers will follow.” Also, there are a number of smaller Vietnamese companies that provide factory infrastructure support, cleanroom supplies, packaging materials, and printing capabilities.

Electronics manufacturing in Vietnam will continue to grow. The country’s growth outlook is bright as GDP is expected to be 6.4% in 2017, according to IHS.

At present, Vietnam is “a destination for low-cost manufacturing but the country will also come up the learning curve,” says Panzica. “The country will be able to do more value-added such as developing its own tooling. In five to 10 years, the country will have that capability to become a turnkey manufacturing center.”

“If you are looking to export out of Asia, Vietnam is an alternative to China,” he says.

About the Author

James Carbone

Freelance Writer

Jim Carbone is a freelance writer covering the electronics supply chain. A veteran journalist, Jim was a writer and editor for Electronics Purchasing and Purchasing magazines for 21 years. He covered electronics distribution, semiconductors, passive components and connectors for the magazines. He also wrote extensively about the strategic purchasing strategies of electronics OEMs and electronics manufacturing services providers. Before covering the electronics industry, Jim worked as a reporter and editor for United Press International for nine years. He started his career as a newspaper reporter and photographer. Jim is a graduate of the State University of New York at Albany.