Download this article in PDF format.

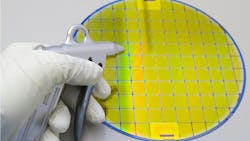

In a new report on Emerging Resilience in the Semiconductor Supply Chain, the Semiconductor Industry Association (SIA) and Boston Consulting Group foreshadow a time in the near future when wafer fabrication becomes more resilient. They say that by 2032, leading-edge wafer fabrication capacity will diversify beyond Taiwan and South Korea to include the U.S., Europe and Japan.

“We expect the U.S. to increase its fab capacity by 203% between 2022 and 2032, the largest increase in the world,” SIA predicts. At that point, the U.S. will have reversed a decades-long downward trajectory and raise its share of global aggregate fab capacity from 10% today to 14% in 2032.”

The CHIPS Act Spurs New Investment

Given the high capital requirements and substantial lead time to bring projects online (upwards of five years in some cases), wafer fabrication is one area where SIA says government and industry efforts have “focused substantially” to date. In fact, the group projects that around $2.3 trillion in private sector investment will be allocated to wafer fabrication between 2024 and 2032, compared with $720 billion in the 10 years prior to enactment of the CHIPS Act (2013-2022).

“The over 100 major semiconductor manufacturing ecosystem projects that have been announced since our prior report are spread out—both around the globe and to new locations within each major region,” says SIA, which pinpoints the key areas as:

Asia: Investments continue at pace across the region. Local companies in Taiwan have announced plans to stand up seven new fabs on the island itself. TSMC is also partnering with Sony, DENSO and Toyota to boost manufacturing capabilities in Kumamoto, Japan, and Japanese officials are helping domestic startup Rapidus set up production lines for cutting-edge 2 nanometer chips at a new site in Hokkaido.

United States: Between 2020 and year-end 2023, 80 new semiconductor manufacturing projects were announced across the United States alone, projected to create 50,000 direct new jobs. A portion of these investments is going to areas with a mature semiconductor footprint, such as Texas, Arizona, New York and California.

Europe: There has been substantial investment in new capacity in Europe, with seven major wafer fab investments announced since 2020. The lion’s share of this capacity is being built in eastern Germany, including Intel’s investment in Magdeburg and TSMC’s joint investment with leading European semiconductor manufacturers to construct a new facility in Dresden.

There’s More to Come

According to the report, the investment pattern for advanced logic has become more globally-distributed with Taiwanese and South Korean companies investing significantly more in the U.S., Europe and Japan. And for logic processes in the range of 10 to 22 nanometers, SIA expects Japan to develop “a meaningful 5% presence from a standing start,” with Mainland China tripling its share from 6% to 19%.

The net result of these specific, strategic and targeted moves by companies is to improve resilience of the industry on a more “average” global capacity share by region.

“Moreover, we expect each major region to grow its capacity by over 80% over the next decade,” SIA concludes. “At 203%, the U.S. will grow capacity at a faster rate than other regions and much faster than in the preceding decade. In terms of thousands of wafer starts per month (300 mm equivalents), this represents an increase from 1,121 kwspm (thousands of wafer starts per month) in 2022 to 3,393 kwspm (203% increase) in 2032.”

About the Author

Avery Larkin

Contributing Editor

Avery Larkin is a freelance writer that covers trends in logistics, transportation and supply chain strategy. With a keen eye on emerging technologies and operational efficiencies, Larkin delivers practical insights for supply chain professionals navigating today’s evolving landscape.