United States Drives Industrial Semiconductor Market

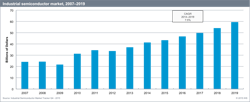

The industrial semiconductor market is set to expand by an 8% compound annual growth rate through 2019, as revenue rises from $43.5 billion in 2014 to $59.5 billion in 2019, according to new research from industry analyst IHS Technology.

The researcher points to continued economic growth and increased capital spending over the next few years as keys to the expansion. Commercial aircraft, LED lighting, digital video surveillance, climate control, traction and medical devices are driving most of the global demand for industrial semiconductors, according to IHS and its Industrial Semiconductors Intelligence Service. Among the recent findings:

- The greatest semiconductor growth will come from LEDs, which is expected to reach $14.5 billion in 2019, stemming from the global LED lighting boom.

- Discrete power transistors, thyristors, rectifiers, and power diodes are expected to hit $7.8 billion in revenue, due to the policy shift toward energy efficiency in the factory automation market.

- Analog application-specific integrated circuits (ICs) can expect strong growth through 2019, reaching $4.7 billion in industrial markets, especially in factory automation, power and energy, and lighting.

- Microcontrollers (MCUs) are also expected to experience robust growth in the long term, growing from $4.4 billion to $6.3 billion, thanks to advances in power efficiency and integration features.

IHS also points to steadily growing factory revenue as key to the positive outlook, noting that industrial original equipment manufacturing (OEM) factory revenue is predicted to grow at a CAGR of 5%, reaching $670 billion in 2019. This follows 6% growth in 2015. Also helping matters is the United States’ comparatively strong economy; the United States accounted for 30% of all semiconductors used in industrial applications in 2015, IHS said. China was second, purchasing about 16% of all industrial semiconductors last year.

“Robust economic growth and increased capital spending in the United States is good news for industrial semiconductor suppliers, because they have the world’s largest industrial equipment makers, including General Electric, United Technologies and Boeing,” said Robbie Galoso, associate director, industrial semiconductors, IHS Technology. “Strong industrial equipment demand will further boost sales of optical semiconductors, analog chips and discretes, which are the three largest industrial semiconductor product segments.”

About the Author

Victoria Fraza Kickham

Distribution Editor

Victoria Kickham is the distribution editor for Electronic Design magazine, SourceESB and GlobalPurchasing.com, where she covers issues related to the electronics supply chain. Victoria started out as a general assignment reporter for several Boston-area newspapers before joining Industrial Distribution magazine, where she spent 14 years covering industrial markets. She served as ID’s managing editor from 2000 to 2010. Victoria has a bachelor’s degree in English from the University of New Hampshire and a master’s degree in English from Northeastern University.